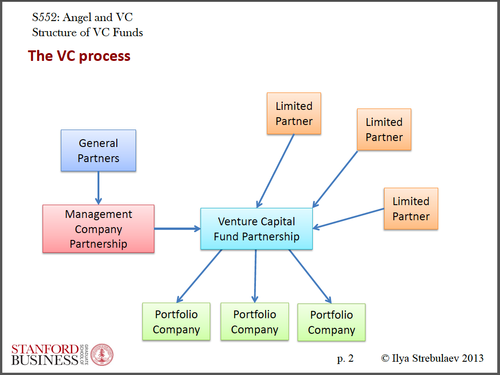

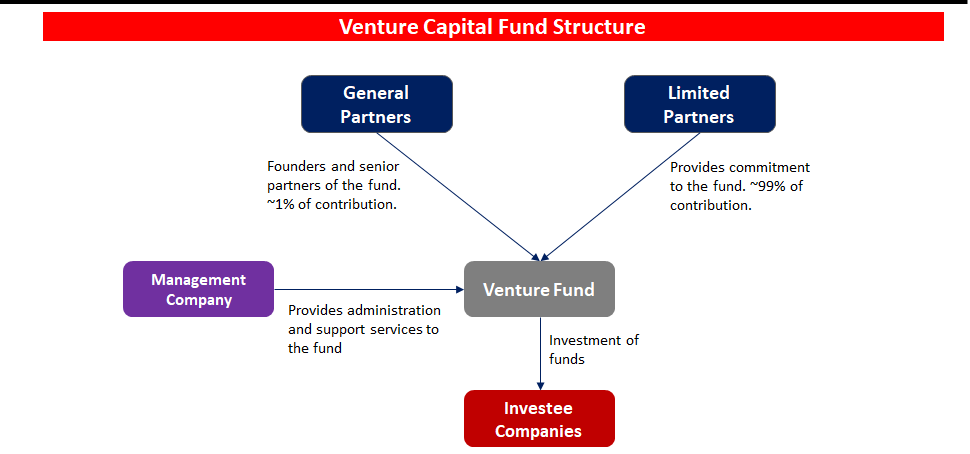

Typically, LPs are wealthy individuals, family offices, endowments, funds of funds, pensions, etc. Just as the existence of a startup may depend (at least to some extent) on the involvement of a VC, the VC is as much reliant on its LPs. The most important players in a Fund are the limited partners or LPs, which are the Fund's investors. However, the Fund's governing documents (in a limited partnership, the Limited Partnership Agreement) do include important restrictions on GP authority without the investors' consent.įor instance, the GP may be limited to making investments consistent with a particular Fund thesis, which may be based on stage (e.g., seed, growth, late-stage), industry sector (e.g., enterprise SaaS, biotechnology, blockchain, clean-tech), or philosophy (e.g., geographic-based). The investors grant broad discretion and authority to the GP in managing the Fund. In a Fund that is formed as a limited partnership, the GP has the power and authority to manage and act on behalf of the Fund, such as making investment decisions, signing contracts (e.g., the Investment Management Agreement with the Management Company), filing tax and regulatory filings on behalf of the fund, and distributing Fund property. In the traditional fund model, the Fund is organized as a Delaware limited partnership, which includes a general partner (e.g., GP entity) and one or more limited partners (i.e., the investors). The GP designation also denotes its role in the traditional fund structure–as the general partner of a limited partnership.

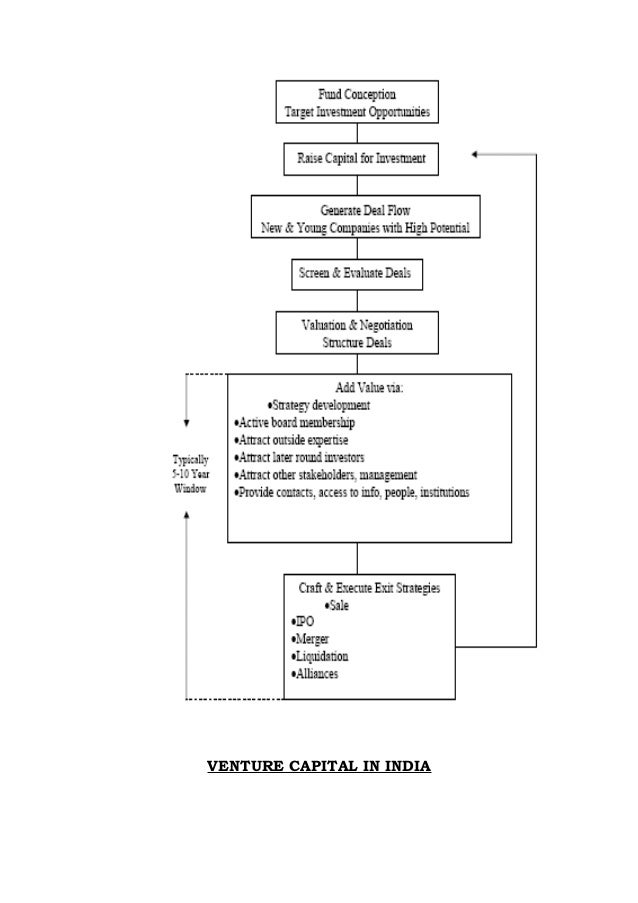

The GPs usually wrap themselves in a legal entity–such as an LLC (e.g., Junto GP I, LLC)- to limit liability and operate through a corporate existence. The founders of the VC firm are often considered the "VC," but the more precise title is general partner or GP. So far, we've used the term VC generically, but many different people and entities may be considered the "VC." In fact, the VC may qualify as an accredited investor simply by raising a Fund above $5M or being a knowledgeable employee of the Fund (more on this in Part III). A VC isn't even required to be an accredited investor independently. While there are plenty of regulatory hurdles, there are no required licenses, specific education, or testing requirements. Similarly, capital calls are also helpful to the VC, who does not want to start the clock on its internal rate of return by calling capital before it is ready to be deployed.Īs we will discuss throughout this series, there aren't many technical barriers to becoming a VC. This allows investors to avoid having their money lying dormant while the VC identifies investment opportunities. Instead, capital calls are made over the Fund's investment period, which is the period in which the VC is authorized to deploy capital (e.g., 3-5 years).

Investors do not typically pay capital commitments at the outset or all at once. A venture capital fund is a type of private fund that: (i) holds itself out to investors as pursuing a venture capital strategy, (ii) holds at least 80% of its assets in " qualifying investments" (e.g., equity or cash), (iii) does not hold debt of more than 15% of its aggregate capital contributions and commitments, (iv) the interests of the Fund are not readily redeemable, except in extraordinary circumstances, and (v) is not registered under the Investment Company Act of 1940.Īn investor's investment into the fund ("Fund") is known as a capital commitment and is made in exchange for an interest in the Fund.

0 kommentar(er)

0 kommentar(er)