I'm here to assist you in fine-tuning reports to focus on the information that is critical to your business. Hi there, recognize the relevance of pulling up both paid and unpaid invoices in QuickBooks Desktop. I'm always here to make sure everything is working fine. You can always ask more questions or reply to me if you still need more help with QuickBooks. Common Custom Reports in QuickBooks Online.Lastly, I have a few more articles to share for additional guidance when running reports in QBO: Check out this article for more details: How Do I Submit Feedback?. They collect all requests and will be reviewed if they can be included in future updates. I'd also like to recommend sending a feature request or feedback to our product engineers. Here's an article as a guide: Export Your Reports to Excel From QuickBooks Online. You can export both reports to Excel so you can combine them and add more customization. For this, you can run the Invoices and Received Payments report. You would also need a separate report to get the amount paid on each invoice. However, this will only show the details per estimate and not per line item. Check all the boxes for Invoiced Amount, % Invoiced, and Remaining Amount.

Click the Customize button in the upper-right hand corner.Open the Estimates and Progress Invoicing Summary by Customer report in the Reports menu.Although, you can customize the Estimates and Progress Invoicing Summary by Customer report will give the Invoiced Amount, % Invoiced, and Remaining Amount columns. Please let me know if you need more assistance managing invoices in QuickBooks Desktop.I'd be glad to jump in and help with your question about getting a report, Tag45.įor now, a report that will show all of the information you enumerated for progress invoicing is unavailable in QuickBooks Online. This allows you to create custom form templates to control how they look and what information to include. You might want to read this article: Use and customize form templates. Go to the Help menu, then select Send Feedback Online and choose Product Suggestion.Open your QuickBooks Desktop company file.To send feedback, please follow the steps below: They may look into this suggestion and consider adding the option in the future update. For now, I encourage submitting feedback directly to our product engineers. I can see that the option to automatically set it up to the sales order or invoice is beneficial to you and your company. This way, it'll calculate the total price and its percentage for the labor charge. Hi there, this time, you'll have to manually enter the subtotal and the rate for each sales order or invoice. If you have more questions about recording invoices, please let me know. I'm happy to show you around in QuickBooks Desktop again. This article can help you build your preferred report: Understand reports. Need to see how much you've made from your mechanic shop? You can check out a bunch of reports to see your sales, expenses and other data. If you've noticed, the labor service item will always calculate the prior item's price. This is what it looks like after creating the transaction:

PROGRESS BILLING IN QUICKBOOKS DESKTOP PLUS

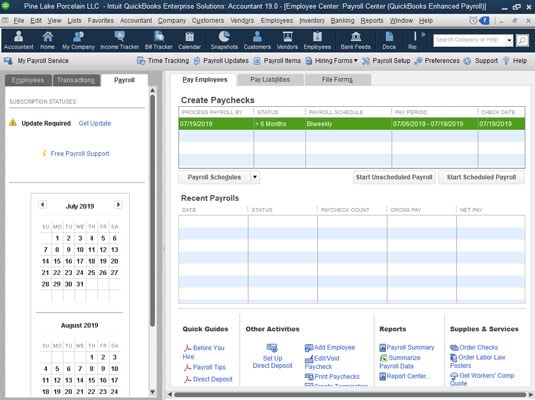

This will calculate the total price of the shop supplies plus the 6% labor charge.Īdd the remaining items for your invoice (the parts in this case). When creating an invoice, you'll want to add the shop supplies first, then add the subtotal item.Īfterwards, use the labor service right below the Subtotal line.

Set the Type as Service, then enter 6% in the Rate box. If you haven't already done it yet, you'll also want to create a labor service as an item. Set the Type as Subtotal, then add a name for it.Right-click on the Item List window, then select New.You'll want to add a subtotal to your shop supplies, then add the labor service to calculate the 6% charge. I have a way to help you calculate the shop supplies on the labor for your mechanic shop.

0 kommentar(er)

0 kommentar(er)